By Anshul Khurana, Cofounder, Entitled Solutions, India

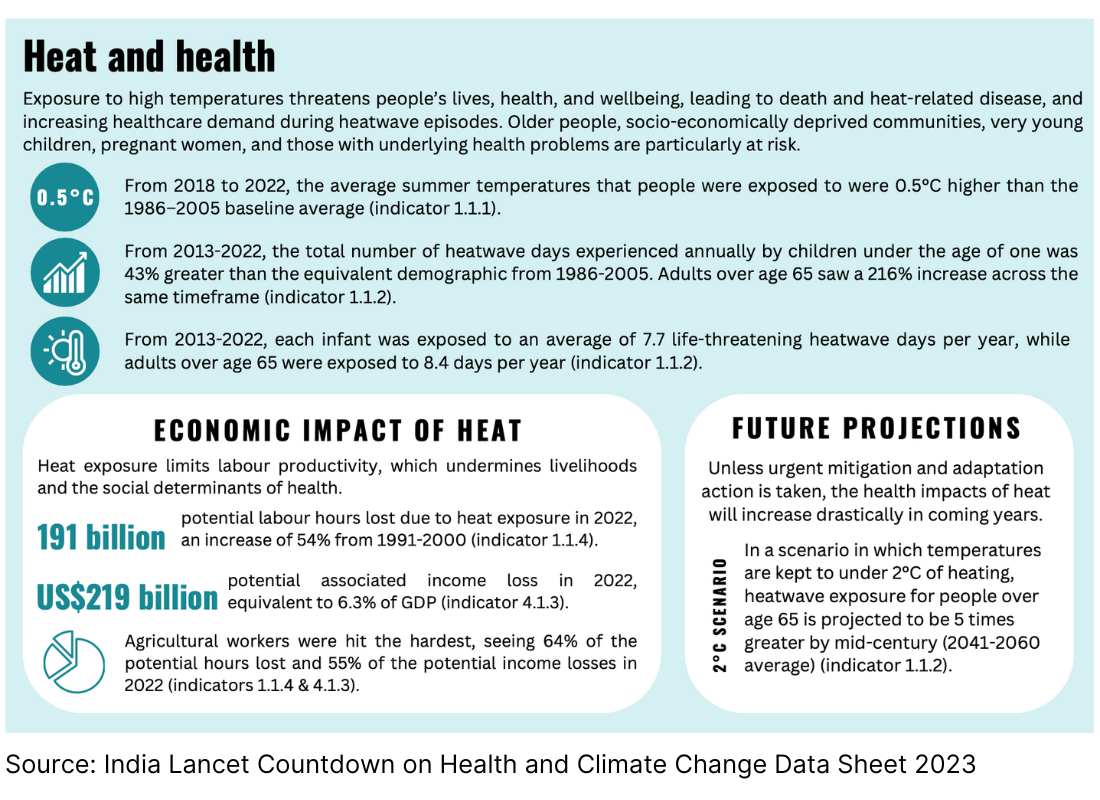

As the frequency and intensity of extreme heat events rise due to climate change, parametric insurance presents a promising solution to help mitigate the financial risks associated with such occurrences. Unlike traditional insurance, parametric insurance triggers payouts based on predefined events, such as crossing a specific temperature threshold. However, to make parametric insurance for extreme heat effective and accessible, key actions must be taken in areas ranging from data infrastructure to policy innovation.

Accurate real-time and historical data allow for objective triggers, ensuring that insurance payouts are made based on clearly defined parameters. However, significant investments in data infrastructure are needed to ensure that these policies can operate effectively. Public-private partnerships can be utilised to expand weather station networks and data-gathering technologies like satellites and IoT devices. This ensures that temperature readings are granular and accurate. Global climate models often fail to capture the variability of temperatures at a local level. Tailoring heat indices to specific regions or urban heat islands will reduce basic risk—the gap between actual losses and the insurance payout—making the insurance more efficient.

Designing policies that reflect the nuances of local environments and heat levels is crucial. Governments, insurers, urban planners, and climate scientists must work together to design flexible policies that are tailored to the needs of different communities or sectors (e.g., agriculture, construction). A system of tiered payouts based on different levels of heat events (small, medium, and extreme) can ensure that policies address a range of scenarios, preventing both overly frequent and insufficient payouts. To incentivise risk reduction, insurance policies can offer benefits to communities that invest in heat-resistant infrastructure, thereby lowering the overall risk.

To ensure equity in protection, parametric insurance must be affordable and accessible to vulnerable groups. Governments can support low-income individuals by offering subsidies or incentives, ensuring they have access to insurance coverage. Microinsurance, with smaller coverage amounts and affordable premiums, can provide crucial financial protection to low-income households. Digital platforms and mobile applications can help streamline the registration and payout processes, particularly for those in remote or underserved areas.

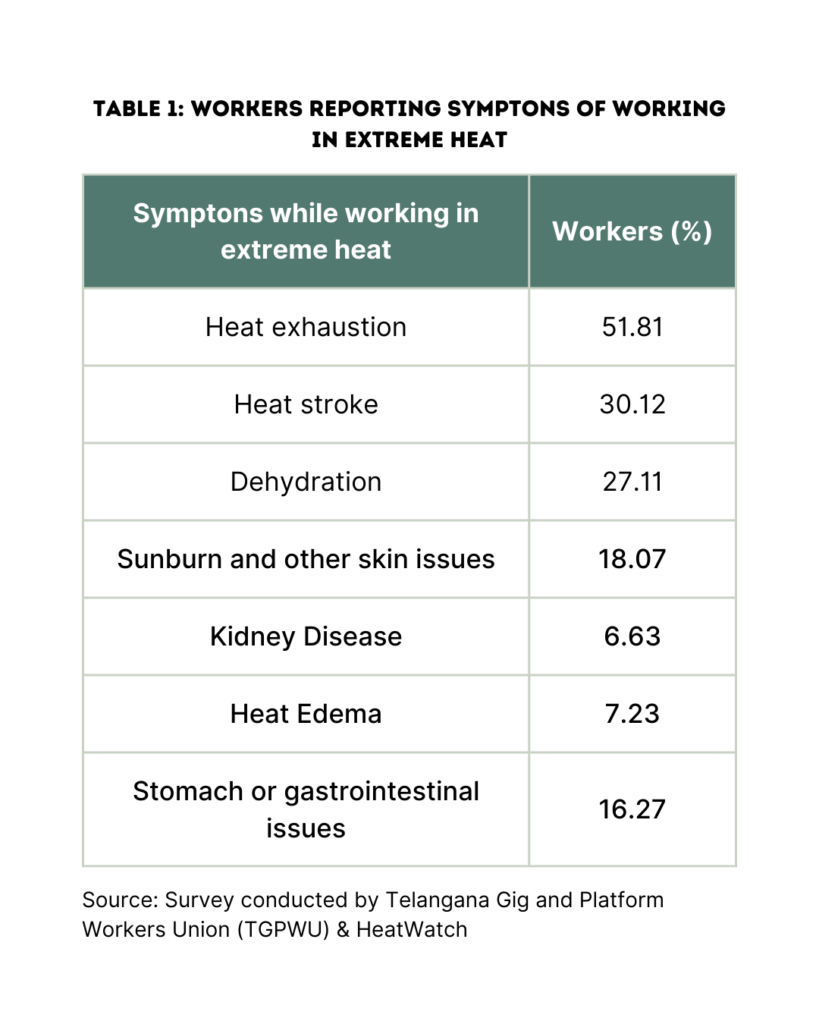

In the urban context, a key cog to enable distribution could be industry bodies or platforms that deal with the vulnerable population such as gig and construction workers. Incorporation of parametric insurance components with other insurance or health programmes could enable widespread adoption in these segments.

Public-private partnerships (PPPs) can help de-risk the market and make these insurance products more viable. Governments can act as reinsurers or provide financial guarantees, enabling private insurers to enter the market with less risk. Institutions like the World Bank can offer technical assistance, financing, and risk-sharing mechanisms to facilitate the expansion of parametric insurance, especially in developing countries. Collaboration with sector-specific experts (e.g., agriculture, construction) ensures that policies cater to the unique needs of each industry, improving their relevance and effectiveness.

A sustained effort to educate and build capacity across communities and sectors is critical for widespread adoption. Governments, insurers, and NGOs should work together to educate communities on the benefits and mechanics of parametric insurance, as well as how to access it. Capacity-building initiatives should target local insurers, financial institutions, and community leaders, empowering them to design and implement policies that reflect the specific needs of their regions.

Parametric insurance should be part of a comprehensive climate adaptation strategy. It works best when integrated with efforts to build community resilience to extreme heat events. Encouraging investments in heat-resistant infrastructure—such as green spaces, cool roofs, and water management systems—can reduce the overall risk, making parametric insurance more effective. Parametric insurance can be tied to early warning systems for heat waves, offering real-time insights into when a payout might be triggered and allowing communities to take pre-emptive measures.

Disclaimer: The views expressed in this piece are those of the author/s and do not necessarily reflect the views or policies of AIDMI.