By Vishal Pathak, All India Disaster Mitigation Institute (AIDMI), India

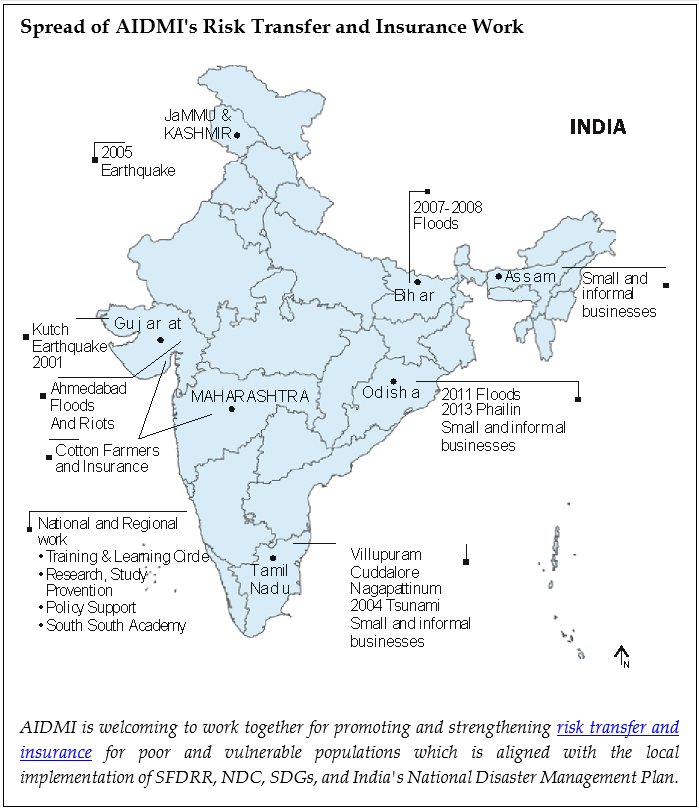

AIDMI has been a pioneering organization in the field of disaster risk management, with a particular focus on risk transfer through insurance. AIDMI has worked extensively to promote microinsurance, parametric insurance, and other innovative financial instruments that support vulnerable communities manage the financial impact of disasters and providing evidence on what works and what not for policy support. Here’s an overview of AIDMI’s journey with risk transfer through insurance, along with key lessons learned.

AIDMI’s Journey with Risk Transfer through Insurance

Conclusion

AIDMI’s journey with risk transfer through insurance has demonstrated that while there are significant challenges, especially in terms of affordability, accessibility, and trust, insurance can play a crucial role in disaster risk management. The key lessons learned—especially the need for customized, community-centered solutions, the importance of collaboration, and the role of education and transparency—offer valuable insights for any organization or government aiming to use insurance as a tool for disaster risk reduction and resilience building.

| Risk Transfer and Insurance: AIDMI Resources

1. Microinsurance: An Innovative Tool for Risk and Disaster Management (read more) 2. GAR Input Paper on Risk Transfer through Microinsurance (read more) 3. AIDMI’s Risk Transfer and Insurance (read more) 4. Making School Safer – AIDMI Initiatives (read more) 5. Loss & Damage, and Anticipatory Action (read more) 6. Building Resilience for Cotton Farmers in India: Evidence from Gujarat and Maharashtra (read more) 7. Southasiadisasters.net (read more) a. Disaster Microinsurance: An Innovation for Transformation, Issue No. 133, July 2025 (read more) b. Risk Insurance and Adaptation: Managing Urban Risks, Issue No. 130, May 2015 c. Adaptation to Climate Change: Linking DRR with Micro insurance, Issue No. 106, March 2014 d. Micro insurance for Disaster Risk Reduction: Post Disaster Recovery of Poor, Issue No. 83, March 2012 e. The Potential of Index-based Insurance for Disaster Management in India, Issue No. 44, Feb. 2008 f. The Impact of Microinsurance in South Asia, Issue No. 43, January 2008 g. Community Risk Transfer Through Microinsurance: An Opportunity for South Asia, Issue No. 13, May 2006 For more information contact: support@aidmi.org |